Share this

ATM Security: Strategies to Combat Skimming and Fraud

ATM skimming and fraud incidents account for 8 out of 10 service calls, according to Owen Wild, Sr. Director Product and Industry Marketing at NCR Atleos. The time and resources spent on managing these fraud calls are becoming more of a burden on financial institutions and costing them big time.

ATM security risks are presenting an ongoing challenge for banks, credit unions, and their consumers. Recent discussions among industry experts have shed light on the evolving tactics used by fraudsters, offering valuable insights into emerging trends and proactive strategies to mitigate risks.

Understanding Today’s ATM Skimming Landscape

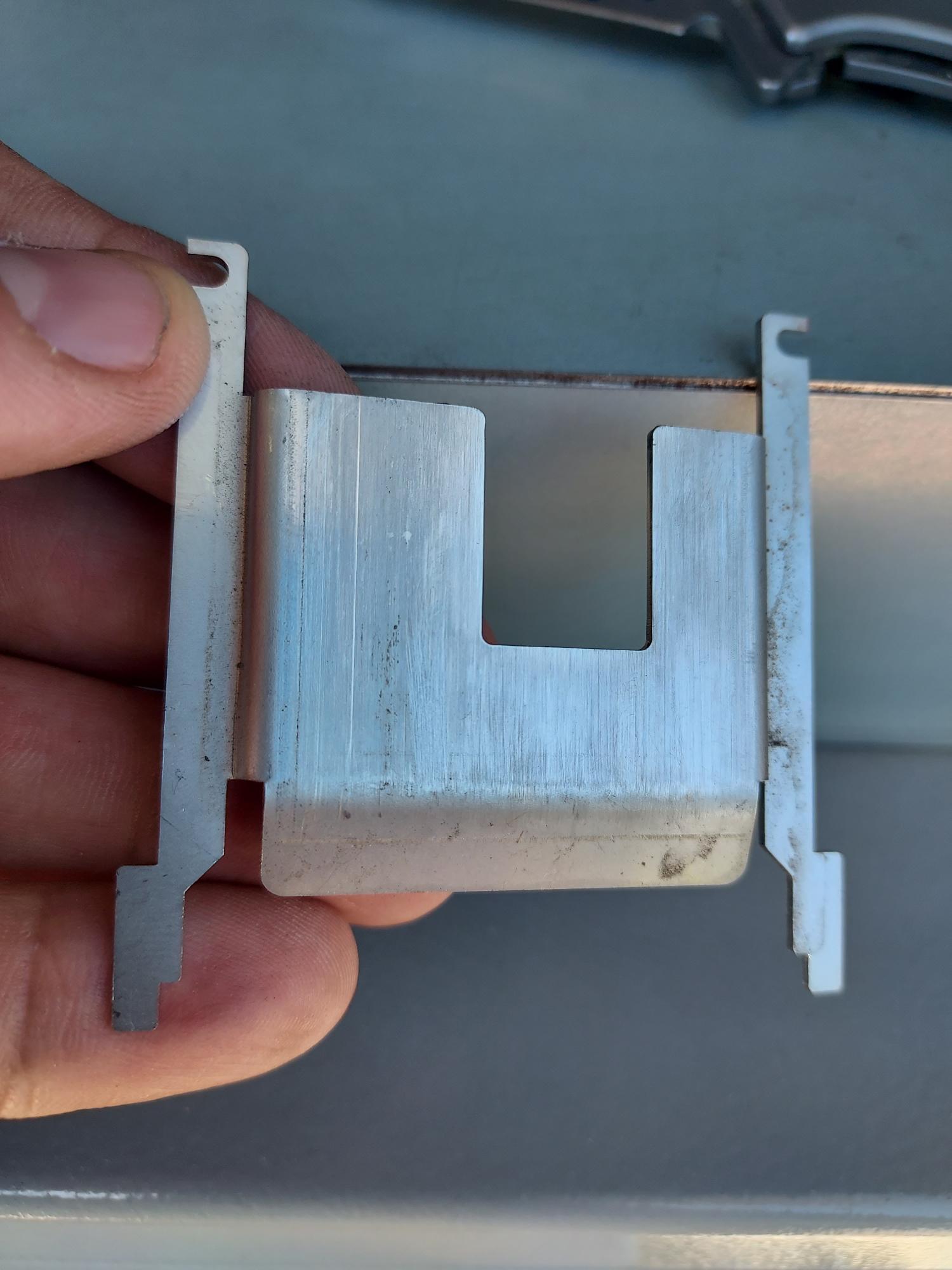

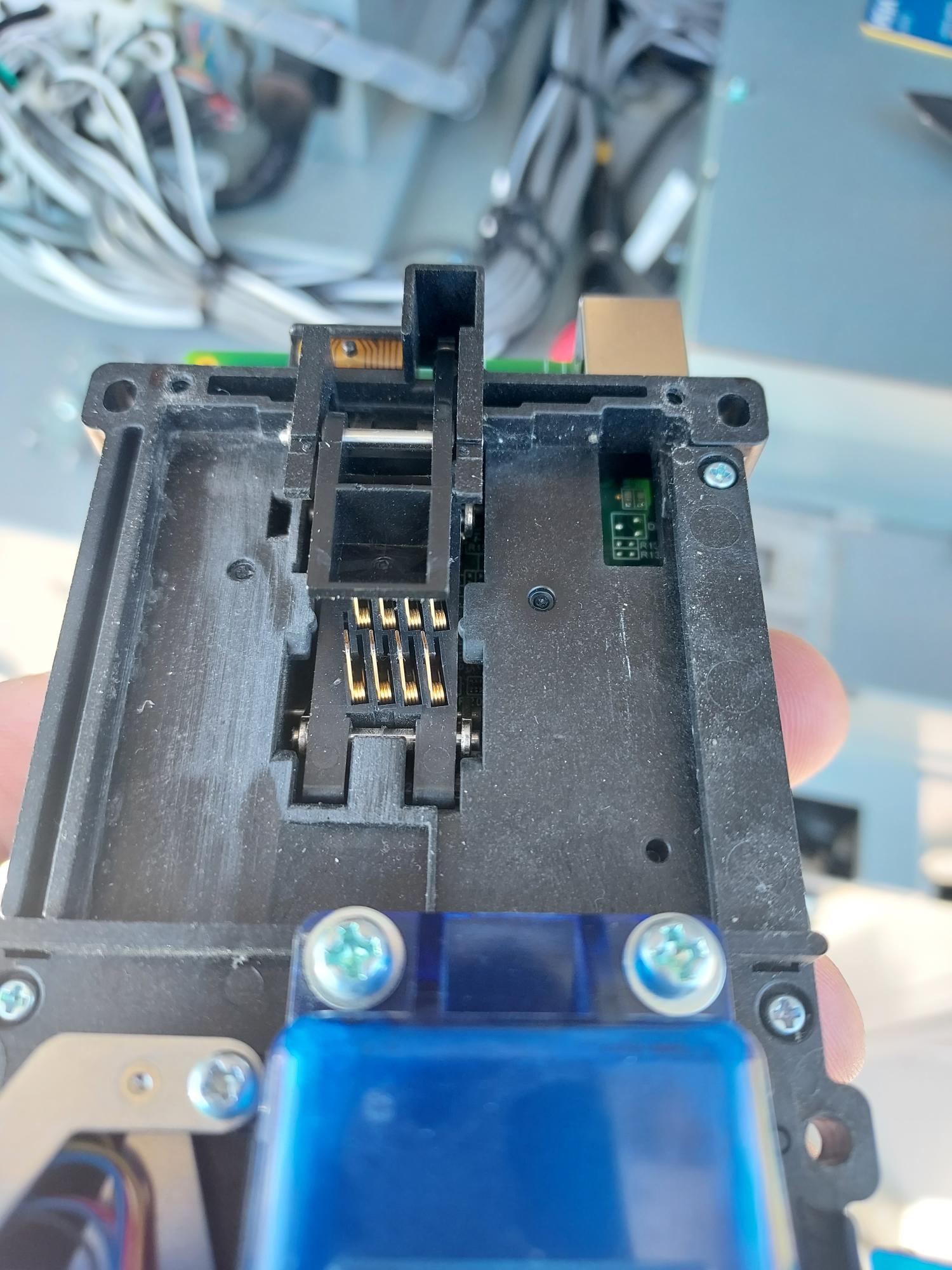

Skimming, once characterized by overlay devices discreetly placed over ATM components, has evolved into a sophisticated operation employing deep insert skimmers and ingenious camouflage techniques. These devices seamlessly integrate into ATM card readers, making them difficult to detect during routine inspections.

A recent case discussed with security experts highlighted the challenge posed by deep insert skimmers. Despite regular maintenance checks, a device installed in an ATM in a busy urban area went undetected for weeks, underscoring the need for enhanced inspection protocols.

The Camouflage of ATM Fraud

Fraudsters have become increasingly adept at camouflaging their illicit devices to evade detection. They often run major crime operations using ATM skimming and other fraud devices purchased online from overseas. Clear plexiglass cameras and 3D-printed overlays mimic legitimate ATM components, making them virtually indistinguishable from the real thing.

Instances have been reported where skimming devices were concealed within seemingly innocuous elements, such as light bars atop ATMs or PIN cameras mounted on the fascia with the same coloring and credit card and banking logos as the real ATM has. Only through meticulous scrutiny were technicians able to uncover these covert devices, highlighting the importance of vigilance and consistent inspections.

ATM Fraud Countermeasures

In response to escalating threats, technological innovations have emerged as a crucial line of defense against skimming. Active shielding bezels, anti-skimming kits, and alarm-equipped trim pieces offer proactive defense mechanisms, triggering alerts upon tampering attempts.

Successful cases have been documented where active shielding bezels thwarted skimming attempts at remote ATM locations. These devices, when tampered with, triggered alarms, enabling authorities to apprehend perpetrators before any data could be compromised.

The Human Factor

Despite technological advancements, human vigilance remains indispensable in combating skimming. Routine inspections, coupled with a culture of suspicion towards unfamiliar elements, play a pivotal role in thwarting fraudsters' efforts.

Well-trained personnel have been instrumental in detecting and reporting suspicious activities promptly, preventing potential fraud from occurring. Staff training programs are essential in maintaining ATM security and fostering a proactive approach to fraud prevention. You can download FTSI’s Daily ATM Inspection Checklist here.

Future ATM Skimming and Fraud Trends

As discussions turn towards future trends, industry experts are emphasizing the need for continuous adaptation and innovation. While contactless technology shows promise in reducing skimming risks, ongoing vigilance and collaboration are paramount.

Research into biometric authentication methods offers hope for a future where physical cards are rendered obsolete, potentially eliminating the risk of skimming altogether. With the elimination of mag stripes, ATM skimming will be essentially obsolete. Such advancements hold the key to a proactive approach to ATM security, where threats are identified and mitigated before they can be exploited. Until then, financial institutions need to stay up-to-date with trends and mitigation techniques.

ATM skimming remains a significant and growing threat in the financial services sector, requiring a multifaceted approach to mitigation. By understanding emerging trends, leveraging technological advancements, and fostering a culture of vigilance, industry stakeholders can stay ahead in the ongoing battle against financial fraud.

> Replay the live discussion with NCR Atleos: ATM Skimming Trends and Mitigation Best Practices <

In conclusion, safeguarding ATM security demands a comprehensive strategy that combines technological innovation with human vigilance. As skimming tactics evolve, so must our defenses, with a proactive stance that anticipates and counters emerging threats. Through collaboration, innovation, and a commitment to rigorous inspection protocols, the financial industry can fortify its defenses against skimming and uphold the integrity of ATM transactions for years to come.

Get Expert Advice >

With over 25 years in bank and credit union security, our experts provide unbiased and practical knowledge and solutions to protect your branches and consumers.

Share this

- 2024 April (2)

- 2024 March (2)

- 2024 February (1)

- 2023 December (1)

- 2023 October (3)

- 2023 September (1)

- 2023 August (3)

- 2023 July (2)

- 2023 June (2)

- 2023 May (2)

- 2023 April (1)

- 2023 March (2)

- 2023 February (1)

- 2023 January (2)

- 2022 December (4)

- 2022 November (5)

- 2022 October (1)

- 2022 September (5)

- 2022 August (2)

- 2022 July (1)

- 2022 May (1)

- 2022 April (2)

- 2022 March (1)

- 2022 January (1)

- 2021 October (3)

- 2021 September (2)

- 2021 August (1)

- 2021 June (1)

- 2021 April (1)

- 2020 December (1)

- 2020 October (1)

- 2020 May (2)

- 2020 March (2)

- 2020 February (1)

- 2020 January (1)

- 2019 October (1)

- 2019 September (1)

- 2019 May (1)

- 2019 March (2)

- 2019 January (3)

- 2018 July (1)

- 2018 June (1)

- 2018 April (2)

- 2018 January (1)

- 2017 December (1)

- 2017 November (1)

- 2017 September (1)

- 2017 August (1)

- 2017 June (1)

- 2017 May (1)

- 2017 April (1)

- 2017 March (1)

- 2017 February (2)

- 2016 December (1)

- 2016 November (1)

- 2016 July (1)

- 2016 February (1)

- 2015 December (1)

- 2015 September (2)

- 2015 July (1)

- 2015 June (1)

- 2015 May (2)

- 2015 April (2)

- 2015 March (1)