Share this

What President Biden’s New “Framework for the Responsible Development of Digital Assets” Means for Financial Institutions

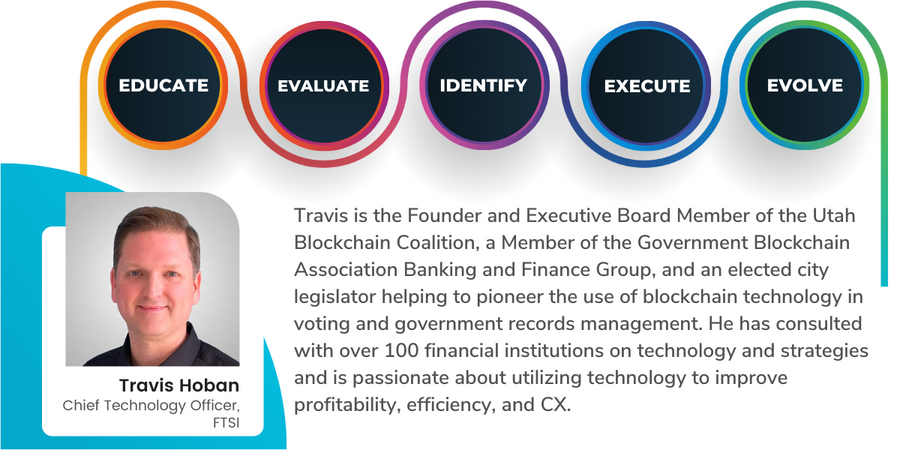

by Travis Hoban

Following the March 9th Executive Order (EO) on Ensuring the Responsible Development of Digital Assets, the White House recently released a report on a Framework for the Responsible Development of Digital Assets.

This report outlined how the White House plans to address the risks and benefits of digital assets in six key areas: consumer protections, promoting financial stability, countering illicit finance, U.S. leadership in the global financial system, financial inclusion, and responsible innovation.

Key Takeaways

- Federal agencies will make a renewed effort to protect consumers.

- Research on the impact of digital assets will continue.

- A U.S. Central Bank Digital Currency (CBDC) is likely.

- Regulatory clarity and guidance for financial institutions is on the horizon.

Consumer Protections

The report reiterated the risks of cryptocurrencies and other digital assets due to fraud and volatility. It also re-committed to the enforcement and prosecution of digital asset fraud and scams in order to protect consumers.

President Biden stated he will consider calling upon Congress to amend the Bank Secrecy Act (BSA) and other laws to apply explicitly to digital asset exchanges and non-fungible token (NFT) platforms.

This would be a significant move towards reducing some of the wild in the “wild west of crypto,” and reducing unfair competition for traditional financial institutions. Currently, many digital asset exchanges and platforms are not held to the same standards as traditional financial institutions regarding Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

This increases costs for traditional financial institutions and puts them at a competitive disadvantage in acquiring and retaining customers and members. Amending BSA and other laws to include digital asset platforms would create a more level playing field.

Additional Research

Before President Biden makes any significant moves in the digital assets space, he would like to see more data and research. He tasked the Office of Science and Technology Policy (OSTP) and National Science Foundation (NSF) to research topics such as cryptography, cybersecurity, privacy, and ways to mitigate the environmental impacts of digital assets. The NSF will also research how digital asset platforms can become more inclusive, equitable, and accessible.

Hinting at the reasons why digital assets have gained so much popularity among certain consumers, the report stated, “traditional finance leaves too many behind. Roughly 7 million Americans have no bank account. Another 24 million rely on costly nonbank services, like check cashing and money orders, for everyday needs. And for those who do use banks, paying with traditional financial infrastructure can be costly and slow—particularly for cross-border payments.”

Central Bank Digital Currency

The framework seems to be pointing the White House in the direction of additional regulation for digital assets. Perhaps more importantly, it will likely lead to the eventual development of a Central Bank Digital Currency (CBDC). A U.S. CBDC would essentially be a cryptocurrency version of the U.S. dollar.

It would be a direct liability of the central bank rather than of a commercial bank or credit union. This is something financial institutions will want to keep an eye on, as a CBDC has the potential to reduce deposits at banks and credit unions, and in turn impact lending capacity.

The report encourages the Federal Reserve to continue its ongoing research, experimentation, and evaluation of a CBDC, and states a U.S. CBDC “could enable a payment system that is more efficient, provides a foundation for further technological innovation, facilitates faster cross-border transactions, and is environmentally sustainable.”

And, as stated in our previous post on the March EO, a U.S. CBDC could also help preserve the dollar’s status as world reserve currency for decades to come. This would be the most significant development in the digital asset space since the creation of Bitcoin.

However, the potential creation of a CBDC begs the question, “where does FedNow fit into all of this?” FedNow is a soon-to-be-released federally sponsored interbank clearing system that will enable real-time payments 24/7.

The report clarifies that a CBDC would not replace FedNow, but rather there is potential for a CBDC to be incorporated into the FedNow system to “facilitate faster payments and make financial services more accessible.”

Regulatory Guidance

So where does this leave financial institutions who have been waiting for further guidance from regulators? Unfortunately, there will be no immediate additional guidance or impact on financial institutions. However, this is the most specific guidance that has been provided thus far by the White House on the direction they will head and the steps they will take towards regulating and exploring digital assets.

It is clear that digital assets are here to stay and will become an even greater part of the financial services landscape soon. The Treasury was tasked with completing a risk assessment on decentralized finance by the end of February 2023, and an assessment on non-fungible tokens by July 2023.

It won’t be long before traditional financial institutions have more clarity and direction as to how they can take advantage of the opportunities provided in the digital asset space.

To learn more about how blockchain technology and cryptocurrency can apply at your financial institution, schedule a consulting call with our in-house expert, Travis Hoban.

Share this

- 2024 April (2)

- 2024 March (2)

- 2024 February (1)

- 2023 December (1)

- 2023 October (3)

- 2023 September (1)

- 2023 August (3)

- 2023 July (2)

- 2023 June (2)

- 2023 May (2)

- 2023 April (1)

- 2023 March (2)

- 2023 February (1)

- 2023 January (2)

- 2022 December (4)

- 2022 November (5)

- 2022 October (1)

- 2022 September (5)

- 2022 August (2)

- 2022 July (1)

- 2022 May (1)

- 2022 April (2)

- 2022 March (1)

- 2022 January (1)

- 2021 October (3)

- 2021 September (2)

- 2021 August (1)

- 2021 June (1)

- 2021 April (1)

- 2020 December (1)

- 2020 October (1)

- 2020 May (2)

- 2020 March (2)

- 2020 February (1)

- 2020 January (1)

- 2019 October (1)

- 2019 September (1)

- 2019 May (1)

- 2019 March (2)

- 2019 January (3)

- 2018 July (1)

- 2018 June (1)

- 2018 April (2)

- 2018 January (1)

- 2017 December (1)

- 2017 November (1)

- 2017 September (1)

- 2017 August (1)

- 2017 June (1)

- 2017 May (1)

- 2017 April (1)

- 2017 March (1)

- 2017 February (2)

- 2016 December (1)

- 2016 November (1)

- 2016 July (1)

- 2016 February (1)

- 2015 December (1)

- 2015 September (2)

- 2015 July (1)

- 2015 June (1)

- 2015 May (2)

- 2015 April (2)

- 2015 March (1)